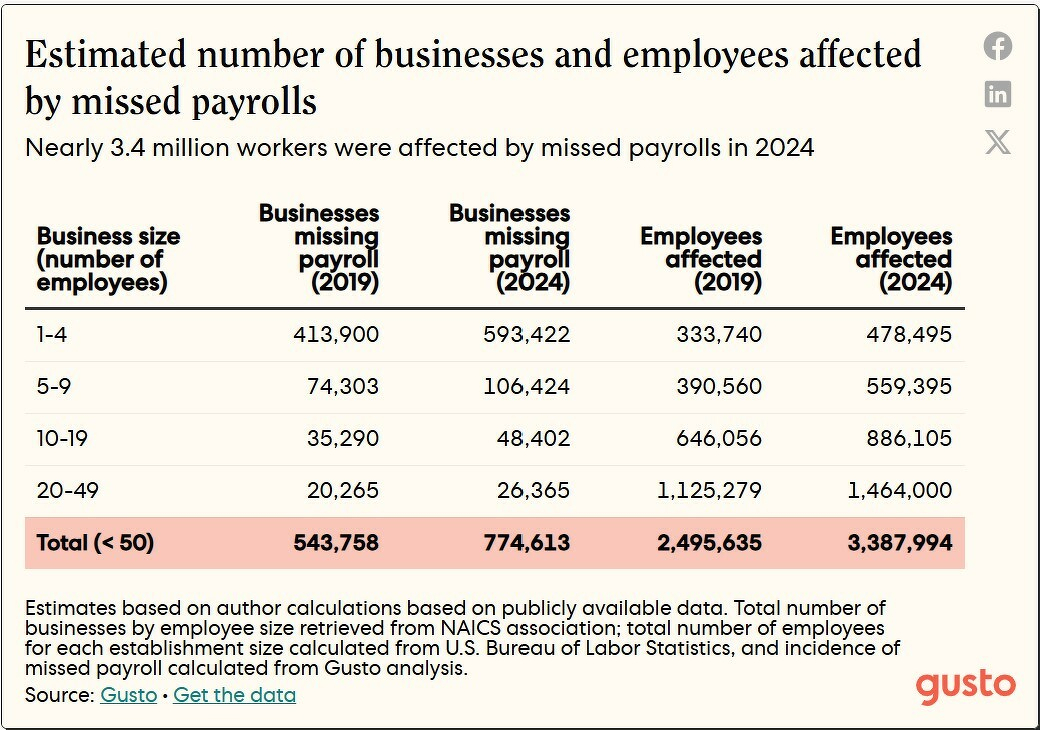

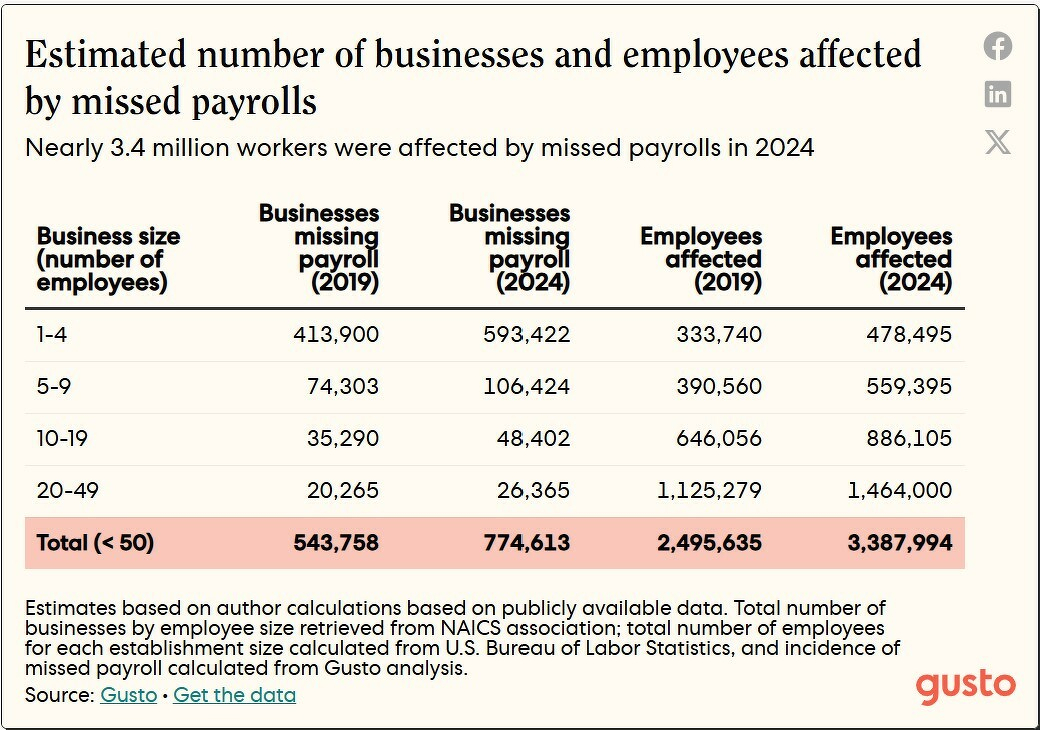

An unsettling number from a recent Gusto report:

Since 2019, the share of small businesses unable to make payroll on time has surged by more than 50 percent, rising from about 1.5 percent to 2.3 percent. That shift may sound small, but across roughly six million employer small businesses, it translates to about 774,000 in 2024—up from 543,000 six years ago.

Their extensive analysis points to a growing vulnerability, one we’ve anecdotally seen across various segments we work with as well:

Small businesses are the backbone of U.S. employment, accounting for nearly 60 million jobs. When they falter, the impact ripples quickly. Between 2020 and 2025, small firms faced overlapping pressures: pandemic disruptions, persistent inflation, and sharply higher interest rates.

Read their post for additional charts and breakdowns.

Our mission remains laser-focused on helping small business entrepreneurs continually design & update their business model and profit model so they can adapt to the changing landscape and build the strength to be successful for many years to come!