Reminder to Individuals & C-corps: The Oct 15 extended deadline is approaching —> To guarantee your return by then, we’ll need the last piece of missing info by Sep 19

Just upload to your e-Cabinet or reply in your Xero Ask query 📥

/StressFreeTax

Reminder to Individuals & C-corps: The Oct 15 extended deadline is approaching —> To guarantee your return by then, we’ll need the last piece of missing info by Sep 19

Just upload to your e-Cabinet or reply in your Xero Ask query 📥

/StressFreeTax

Reminder that federal Tax Credits for energy efficiency expire Sep 30 and Dec 31 – this includes:

Electric vehicles on Sep 30,

Home improvement projects on Dec 31, and

Solar panels on Dec 31.

Additional details in this IRS FAQ.

Reminder to S-corps & Partnerships: The Sep 15 extended deadline is approaching —> To guarantee your return by then, we’ll need the last piece of missing info by Aug 22

Just upload to your e-Cabinet or reply in your Xero Ask query 📥

/StressFreeTax

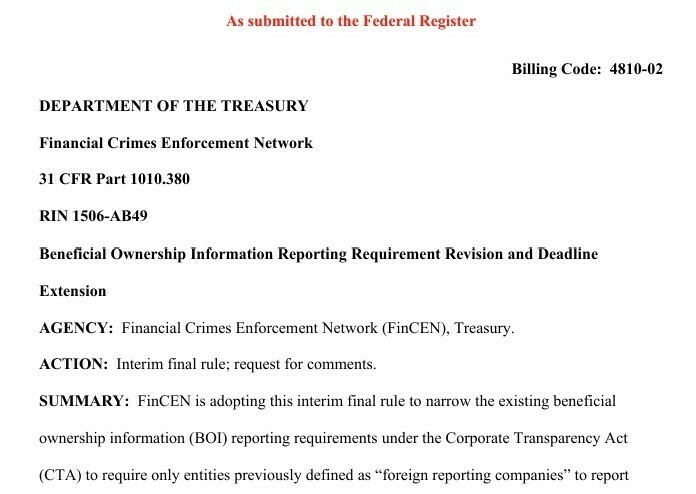

After a year+ of angst, and with explicit reference to the change in federal Administrations, Beneficial Owner Report (BOI) filing requirements are now -removed- for US companies & persons

The Interim Final Rule released Mar 21 (expected to become final) essentially states only foreign entities filing to do business in the U.S need to comply with FinCEN’s BOI reporting rules

It’s been a long road here, but definitely simplifies things for small business owners out there

FinCEN’s press release and additional coverage at JofA

Reminder to Individuals & C-corps: The April 15 filing deadline is approaching —> To guarantee your return by then, we’ll need the last piece of missing info by Mar 21

Just upload to your e-Cabinet or reply in your Xero Ask query 📥

/StressFreeTax

🚨BOI enforcement is now officially on hold ->

The gist: While the legality of the law requiring BOI isn’t currently being challenged (what all the hoopla was these last 4-5 months), FinCEN is now softening their approach, viz:

The recently published Mar 21 deadline is now lifted, with a different later deadline to be shared sometime before then

Enforcement of BOI has been suspended while FinCEN updates their regulations to more closely target higher risk entities (rather than sweeping up all average small biz)

So the saga continues, but thankfully at least moving in a direction simpler for small business 🎭

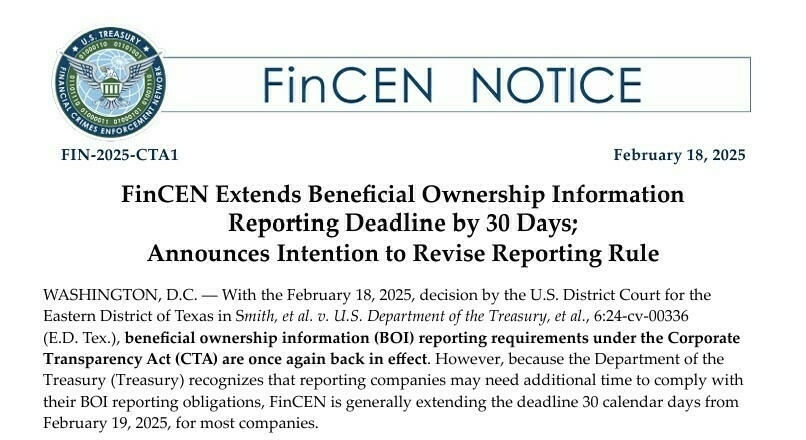

In yet one more installment in the BOI drama – BOI reporting is back on again and due Mar 21

It’s certainly been an on-again, off-again scenario multiple times, but the last remaining injunction was lifted on Feb 17 and FinCEN has stated that the Beneficial Ownership Information (BOI) reporting requirements are back and now due Mar 21

In a notable nod, FinCEN also announced they’d be revisiting the reporting rules for low-risk entities like small businesses and looking for ways to make it easier for them

For help filing, you can see our video provide step-by-step guidance.

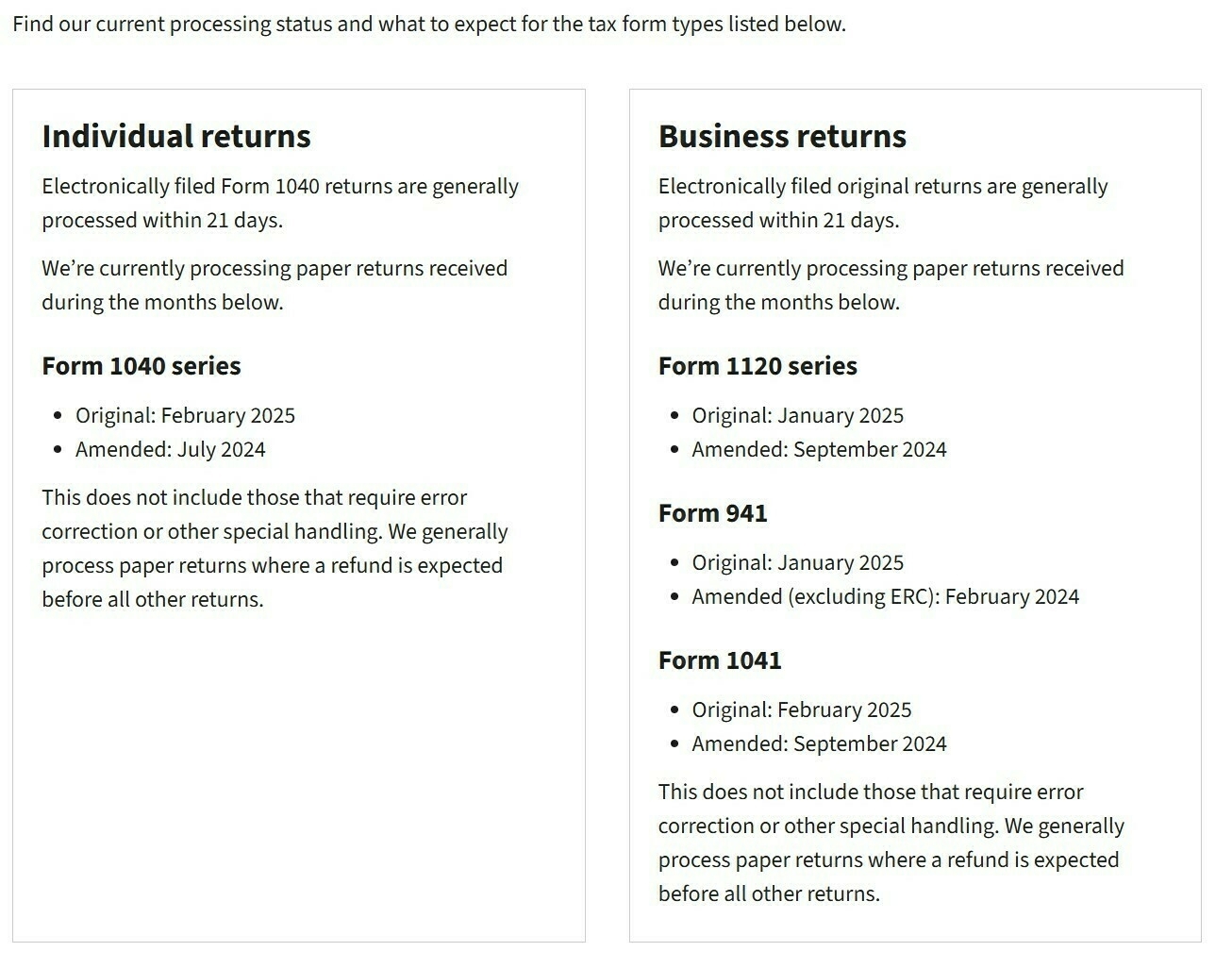

We’ve been noticing the IRS has been showing greater than normal processing delays for amended returns – And the IRS status page indicates the same:

Amended individual returns: Now processing from Jul 2024

Amended corporate returns: Now processing from Sep 2024

Individual general correspondence: Oct 2024

Business general correspondence: Aug 2024

The undercurrent: If your return or situation doesn’t fit squarely into an existing hole, it’s taking a lot longer than usual. And the recent release of 6,000 IRS employees isn’t likely to help matters unfortunately. :/

Be sure to check out our latest blog post “Tools & Checklists for 2024 Small Business & Individual Tax Returns” –>

You’ll find loads of helpful resources all in one place, including:

A very handy compilation of resources indeed. 👍

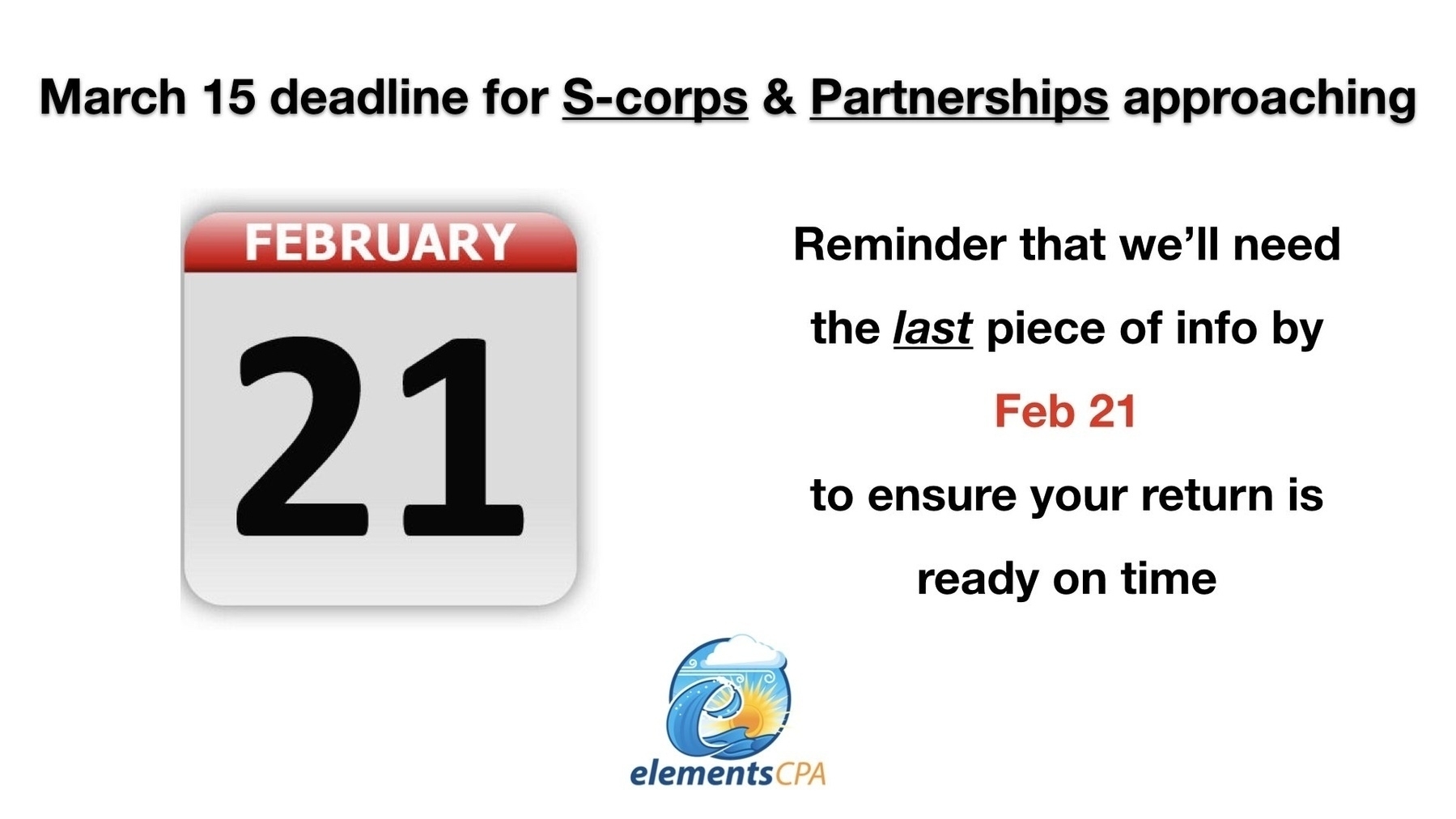

Reminder to S-corps & Partnerships: The March 15 deadline is approaching —> To guarantee your return by then, we’ll need the last piece of missing info by Feb 21

Just upload to your e-Cabinet or reply in your Xero Ask query 📥

/StressFreeTax

Tax Interview appointments are emailed & postcards are in the mail!

You should have seen an email from our team this week for your RSVP -> If you haven’t, please be sure to reach out to Alcides to double-check

And if you need to re-schedule, just let Alcides know – The sooner, the better: as you might imagine, tax season is our tightest calendar time of year 📆

In yet another twist in the FinCEN’s Beneficial Ownership Information (BOI) reporting tug-of-war –> A federal district court issued a nationwide injunction against enforcement of BOI pending further review

Voluntary reporting is still permissible, and it remains to be seen which way and how quickly this new development will go

“What to Know About the Five-Year Rule for Roths” via Schwab

There are actually several versions of the five-year rule governing Roth accounts, some of which overlap, and falling afoul of any of them could trigger additional taxes and penalties.

A great summary of what to know.

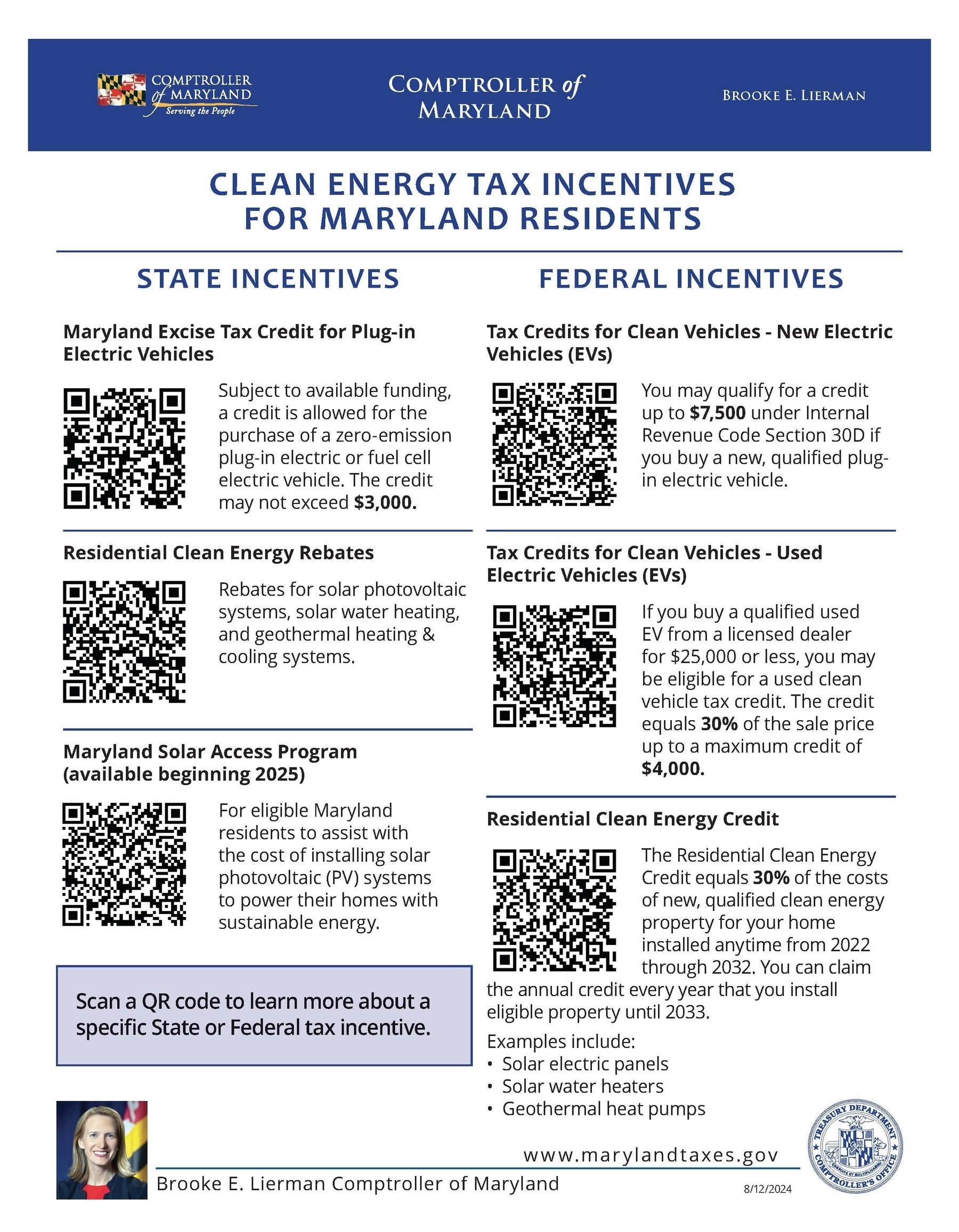

Energy efficiency incentives are available at both the federal and Maryland level, so check out these links if you’re contemplating, or have already, purchased an EV or use solar in some shape or form

Not only is the IRS' new DirectFile system going to be available in Maryland starting next year …

Maryland will also have its own “FileYourStateTaxesMD” platform that the same taxpayers can use to file their corresponding state return as well

What does that mean? -> Around 700,000 Marylanders will have the ability to file their income taxes for free using software created by the IRS and MD - wow.

You do have to be sure your return is on the simpler side in order to qualify (since the platform can only handle some complexities), but if it does, this promises to be a great stride forward for streamlining tax filings for hundreds of thousands of people!

See the link above for more info!

The IRS recently released a ‘Scam Alert’ for misleading claims about non-existent “Self Employment Tax Credit” ->

We’ve actually had at least a handful of customers reach out to us about this one, and we like this line from the IRS' press release:

Taxpayers urged to talk to a trusted tax professional, not rely on marketers or social media for tax advice

I don’t fully know why, but the last few years there’s been this rash of small business ‘tax advice’ on TikTok, Instagram, & similar platforms from people who clearly don’t know what they’re talking about -> We have to agree with the IRS' advice on this one :)

Have you submitted your business' newly required “Beneficial Ownership Information Report” (BOI)?

Although still an unfolding situation, at a July 9 House Financial Services Committee hearing, Department of the Treasury Secretary Janet Yellen said ‘there are no plans to extend the Beneficial Ownership Information (BOI) reporting deadline’.

That deadline? Dec 31 for business that were already in existence when this year began.

For many small businesses it’s a fairly easy process – Check out our video tutorial in our YouTube channel for a walkthrough.