Gov. Moore released his proposed 2027FY Maryland budget this week, a first take at attempting to bridge the $1.4b deficit

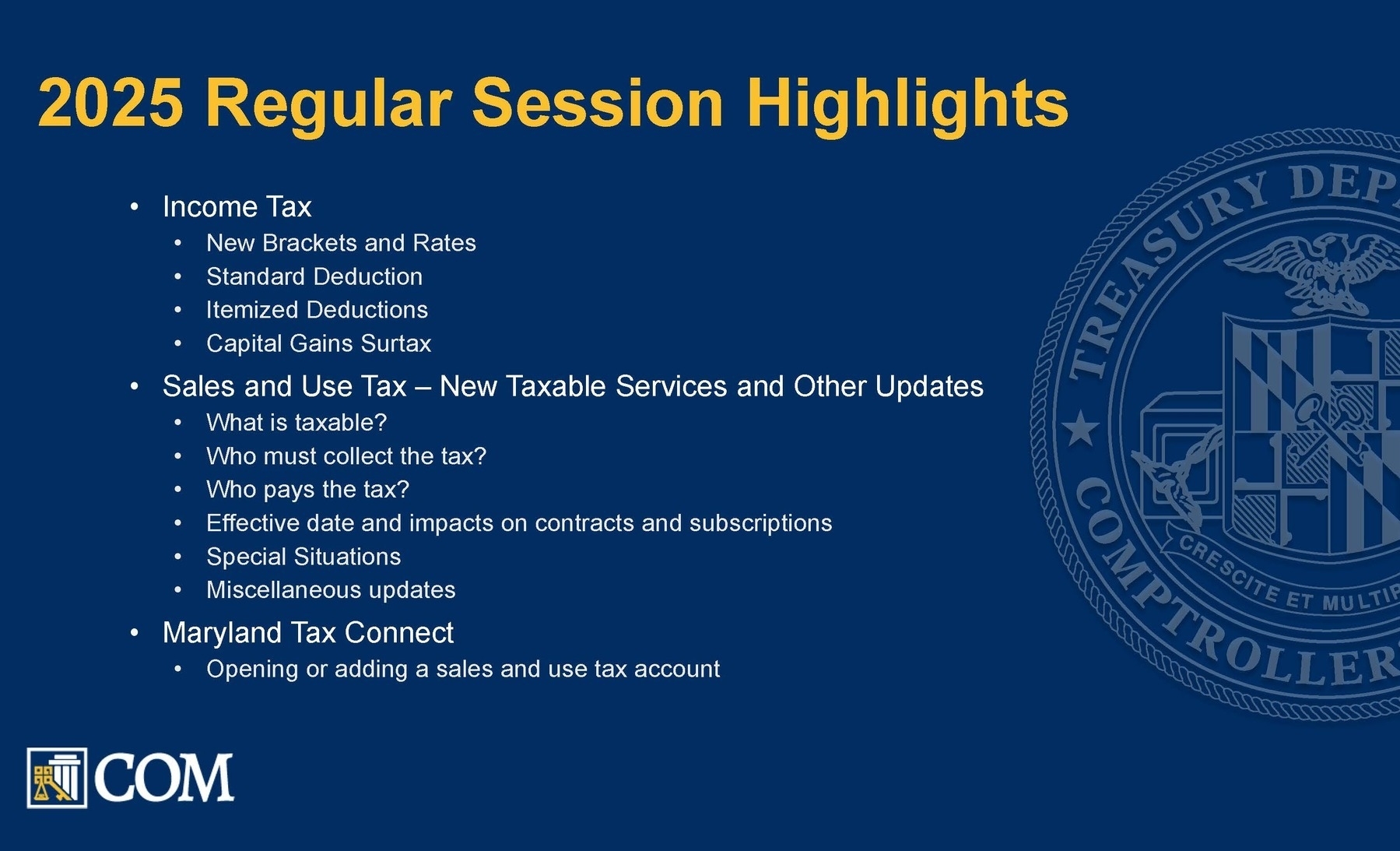

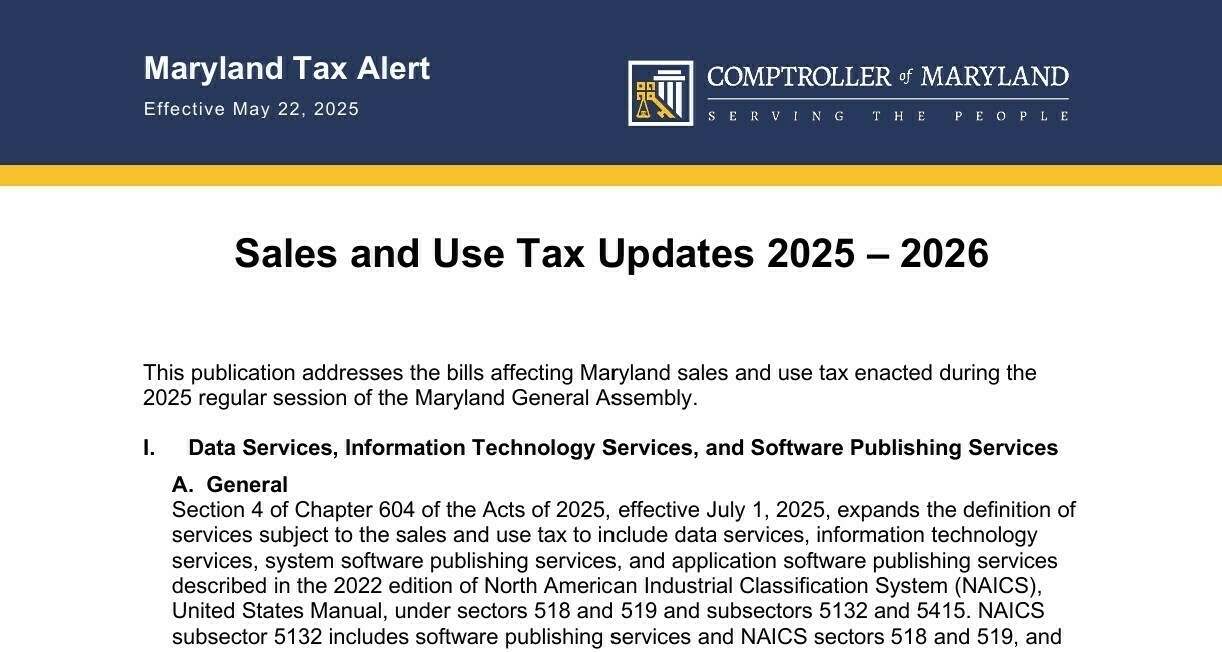

With a stated intent to avoid any new taxes or fees this year (on the heels of notable ones last year), there’s a mixed bag on income tax policy:

-

$100m in tax savings for businesses by allowing certain new federal deductions to also be claimed at the MD level (such as R&D expenses equipment expensing)

-

But these are expected to be offset by $132m in disallowing certain new federal deductions to be claimed on the state return

Of course, the budget is now in the hands of the Maryland General Assembly, and there’s a 90-day run until session ends April 13, so we’ll be watching to see what happens.

(More info via Maryland Matters coverage)