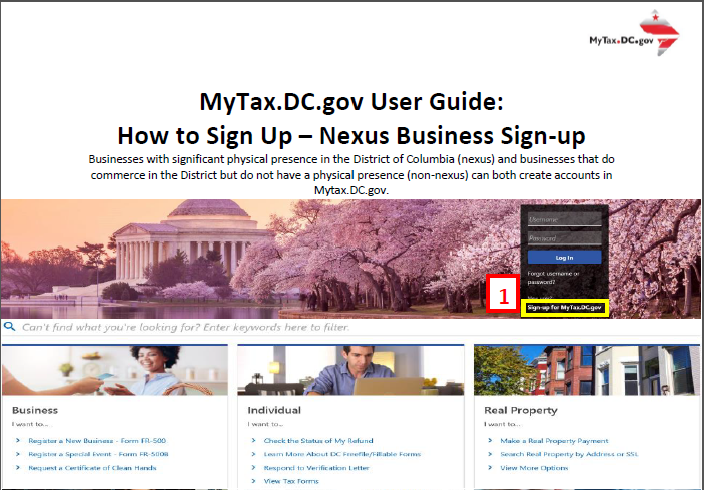

Not only is the IRS' new DirectFile system going to be available in Maryland starting next year …

Maryland will also have its own “FileYourStateTaxesMD” platform that the same taxpayers can use to file their corresponding state return as well

What does that mean? -> Around 700,000 Marylanders will have the ability to file their income taxes for free using software created by the IRS and MD - wow.

You do have to be sure your return is on the simpler side in order to qualify (since the platform can only handle some complexities), but if it does, this promises to be a great stride forward for streamlining tax filings for hundreds of thousands of people!

See the link above for more info!